Article Written by: TrustPlus

For full TrustPlus blog post, click here. TrustPlus is a financial wellness benefit that eases everyday money worries with personal coaching and action-oriented tools and products.

If you’re reading this article, congratulations! Not only are you navigating the beautiful struggle of parenthood, but you are also investing precious free time in planning how best to move your family’s finances forward using the Child Tax Credit!

Let’s jump right in! The two main questions I’ve been hearing from my clients are “will I be receiving any money?” and “what can I do to take full advantage of this financial opportunity?”

Do I qualify, how much will I receive, and when will I receive the money?

Qualifying parents will receive up to $3,600 per child under age 6, up to $3,000 per child ages 6 to 17, and up to $500 per child ages 18 to 24, with no cap on the amount of qualifying children. Whether you receive the FULL Child Tax Credit depends on your income — BUT REMEMBER — you may still qualify for some money even if you make significantly more than the income thresholds listed below (if you’re unsure just how much you’ll receive after reviewing the charts below, you can use the calculator found here):

Keep in mind:

- If you did not file taxes in 2019 or 2020 and also did not use the IRS non-filer portal to access a stimulus check, you can use this link to update your information with the IRS to make sure you receive your monthly Child Tax Credit payments.

- If you had a child after filing your 2020 taxes, had a change in marital status, or experienced a drastic change in income, you can use this separate link to update your information with the IRS to make sure they send you the right amount of money (this option will be available shortly, according to the IRS). You can also use it to opt out of the monthly payments should you prefer to receive the entire Child Tax Credit in lump sum when you file your taxes next year.

- ITIN filers with children who have Social Security Numbers do qualify!

How can I use this money to help my family get ahead?

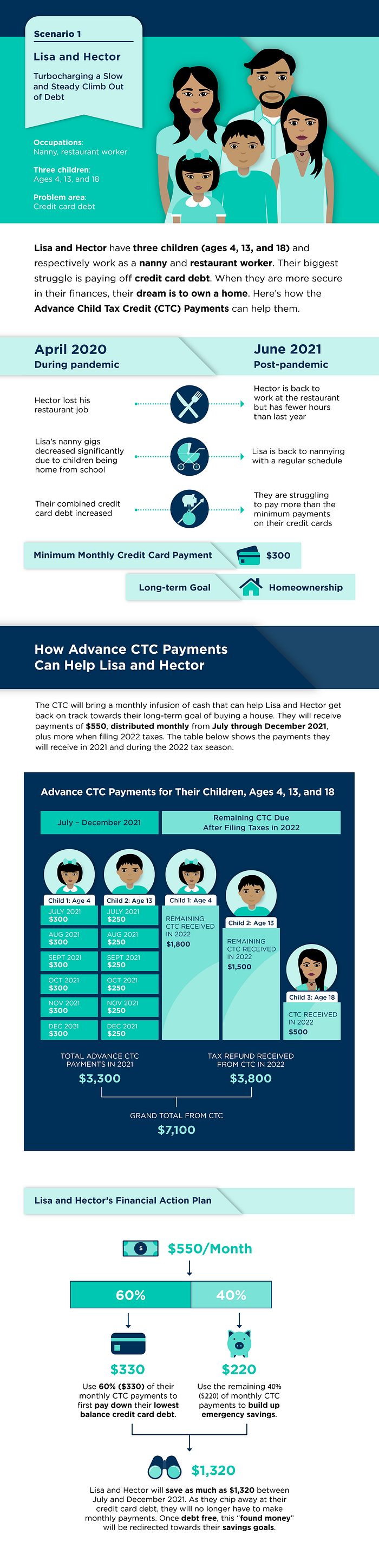

While it is absolutely true that no two financial situations are exactly alike, as a Financial Coach who advises dozens of clients every week, I see emerging patterns. Rather than try to guess the specifics of your personal financial situation, I’ve combined the diverse client situations I see into two scenarios. If you relate to one or both of the examples shared below, consider the recommendations, adjusting them to fit your family’s financial goals.